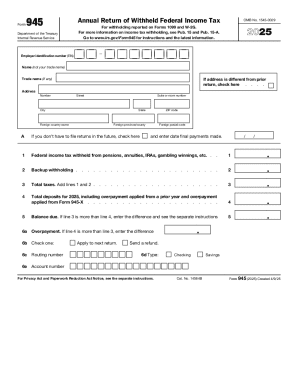

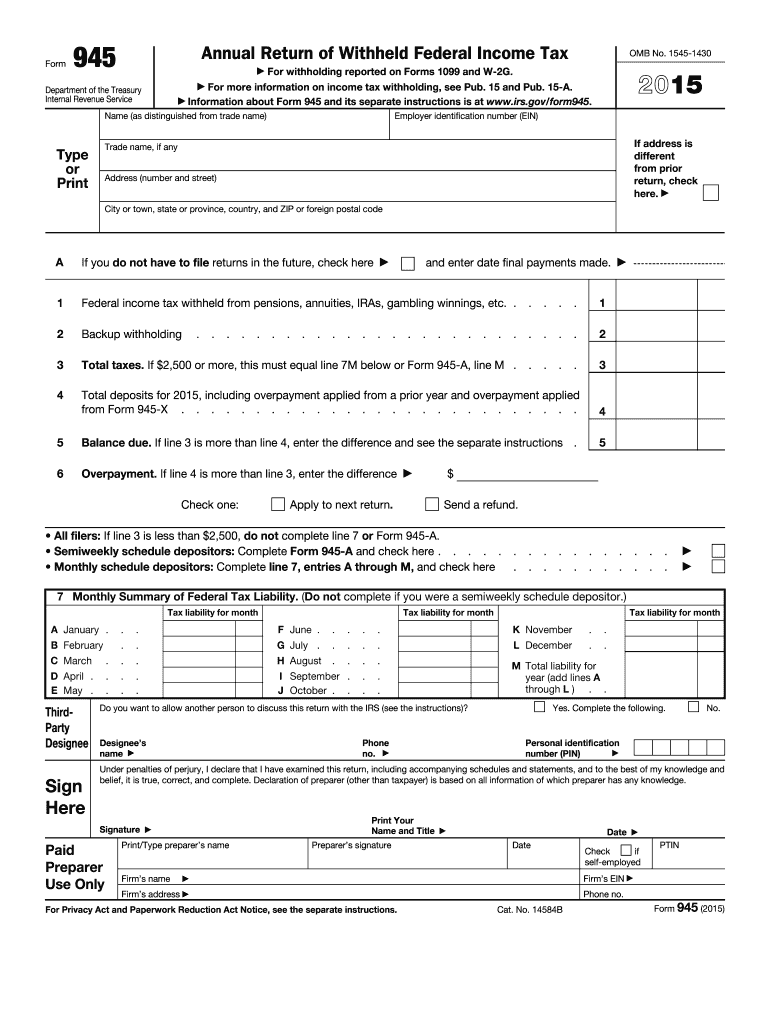

IRS 945 2015 free printable template

Instructions and Help about IRS 945

How to edit IRS 945

How to fill out IRS 945

About IRS previous version

What is IRS 945?

When am I exempt from filling out this form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

Who needs the form?

What are the penalties for not issuing the form?

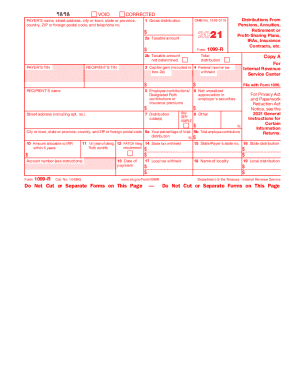

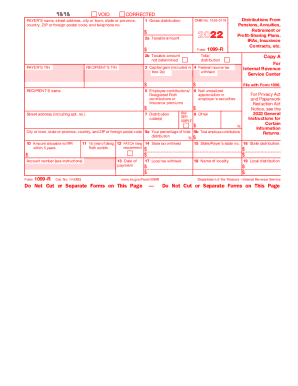

Is the form accompanied by other forms?

FAQ about IRS 945

What should I do if I realize I've made an error after submitting the 2015 form 945?

If you discover an error after submitting your 2015 form 945, you should file an amended form to correct the mistake. Ensure that you clearly indicate that it is an amended return. It is essential to keep a record of both the original and amended submissions for your records, as they may be used for future reference or auditing.

How can I verify the status of my submitted 2015 form 945?

To check the status of your submitted 2015 form 945, you can contact the IRS directly or use their e-file system if you submitted electronically. Common rejection codes may indicate specific issues that need to be addressed before the form can be processed, so it's helpful to have these codes ready when inquiring about your submission.

Are e-signatures acceptable when filing the 2015 form 945?

Yes, e-signatures are generally acceptable for filing the 2015 form 945 if you comply with the IRS guidelines regarding electronic submissions. Ensure that your e-signature meets the necessary legal requirements, and retain adequate documentation as proof of your submission.

What should I do if I receive an audit notice regarding my 2015 form 945?

Upon receiving an audit notice related to your 2015 form 945, it's crucial to respond promptly. Review the notice carefully, gather the requested documentation, and prepare to explain any discrepancies. Consulting with a tax professional may also help you navigate the audit process effectively.

Can I file the 2015 form 945 on behalf of someone else?

Yes, you can file the 2015 form 945 on behalf of another individual or entity if you have the appropriate authorization, such as a Power of Attorney (POA). Ensure that all necessary documentation, including the POA, is submitted along with the form to avoid processing delays.

See what our users say